Short Introduction to the Citadel DAO

April 28, 2022•646 words

Tips: This post is organized in a slideshow style.

How to be the largest Bitcoin holder?

How to be the largest Bitcoin holder, together?

The largest so far except Satoshi

- Luna Foundation Guard: LFG

- MicroStrategy

The largest so far except Satoshi

- ~~Luna Foundation Guard: LFG~~

- ~~MicroStrategy~~

- Citadel DAO ✅

What's Citadel DAO?

Citadel is a treasury DAO aiming to be the largest community owned Bitcoin position in the world.

The treasury and protocol will be governed by the CTDL token, with a predominant Bitcoin treasury actively earning yield and shared with long term CTDL holders.

What's Treasury DAO?

DAO's Treasury -> Treasury DAO

- BitDAO

- AladdinDAO?

- OlympusDAO (largest so far?)

- ...

What's Governance Token?

- for governance (UNI/ENS)

- for monetary incentives (CRV/CVX/BAL)

How it works in a nutshell?

Treasury Assets

- Bitcoin (main target)

- Other yield influence assets (e.g. CVX and Badger) for boosting yield

Mechanism

- Swap Bitcoin or yield influence assets for xCTDL (interest bearing Citadel) at a discount price

- Lock xCTDL for 21 weeks to receive a boost weight in CTDL emissions and other earnings sharing

Three Steps

Basic Operations

Explain Like I’m 5!

Bond 🏛️ (4,4) --> Lock 🔒 ve(3,3) --> Breathe! 👃🤑

Explain Like I’m 5!

Bond 🏛️ (4,4) --> Lock 🔒 ve(3,3) --> Breathe! 👃🤑

TLDR: It looks like the OlympusDAO with treasury assets focusing on BTC and putting assets into badger or other yield protocols.

Token in Different Forms

- CTDL

- xCTDL

- vlCTDL

CTDL --(stake)--> xCTDL --(lock)--> vlCTDL

What Matters Most to a Treasury DAO?

- How to make treasury grow fast?

- How to maintain sustainable yield?

How to Make Treasury Grow Fast?

- A successful launch

- An attractive yield

How to Maintain Sustainable Yield?

- Accelerated treasury growth

- Good tokenomics

- Good yield strategies

Target APR

Yield Strategy Example

Tokenomics

BTC / ETH / USD

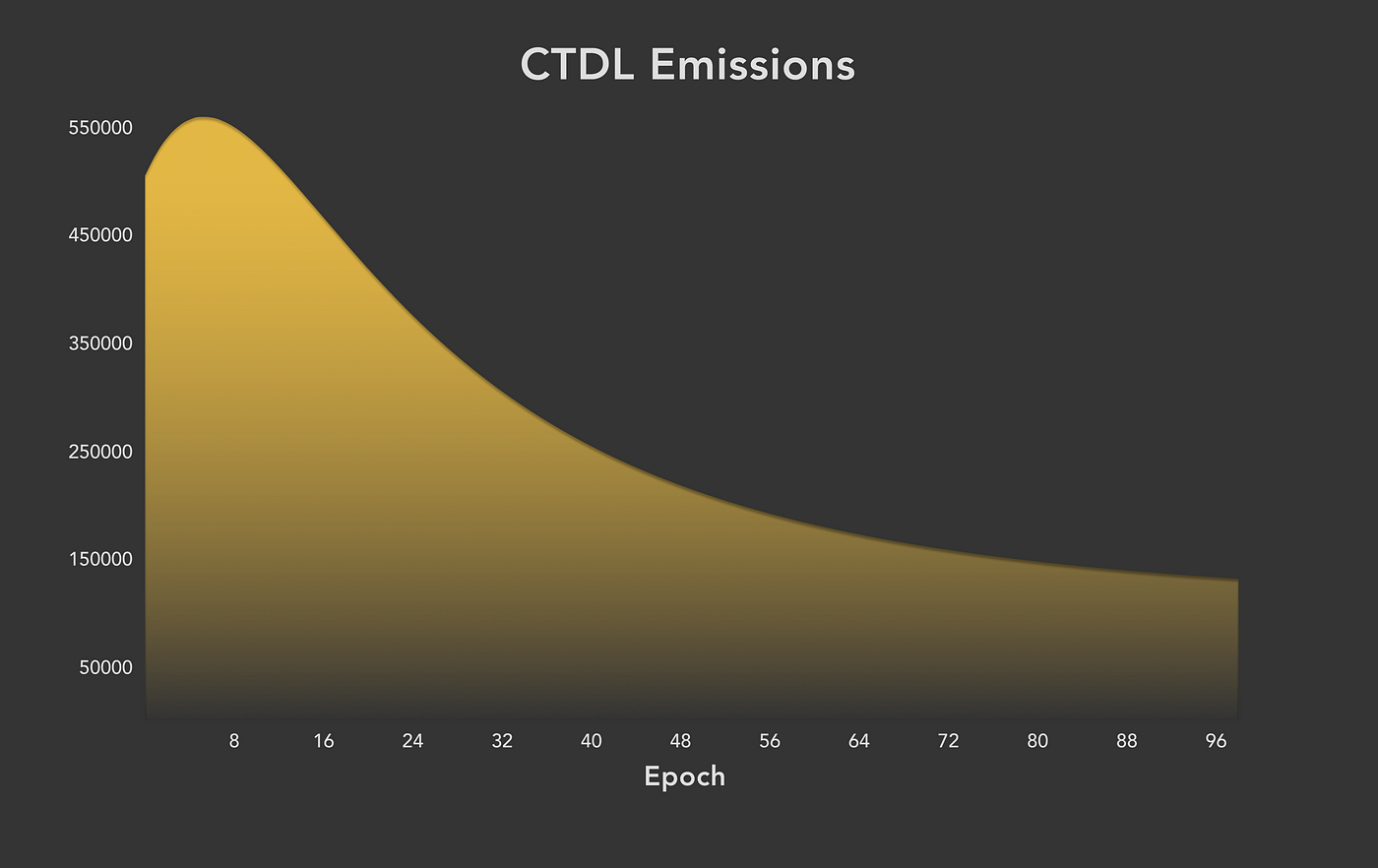

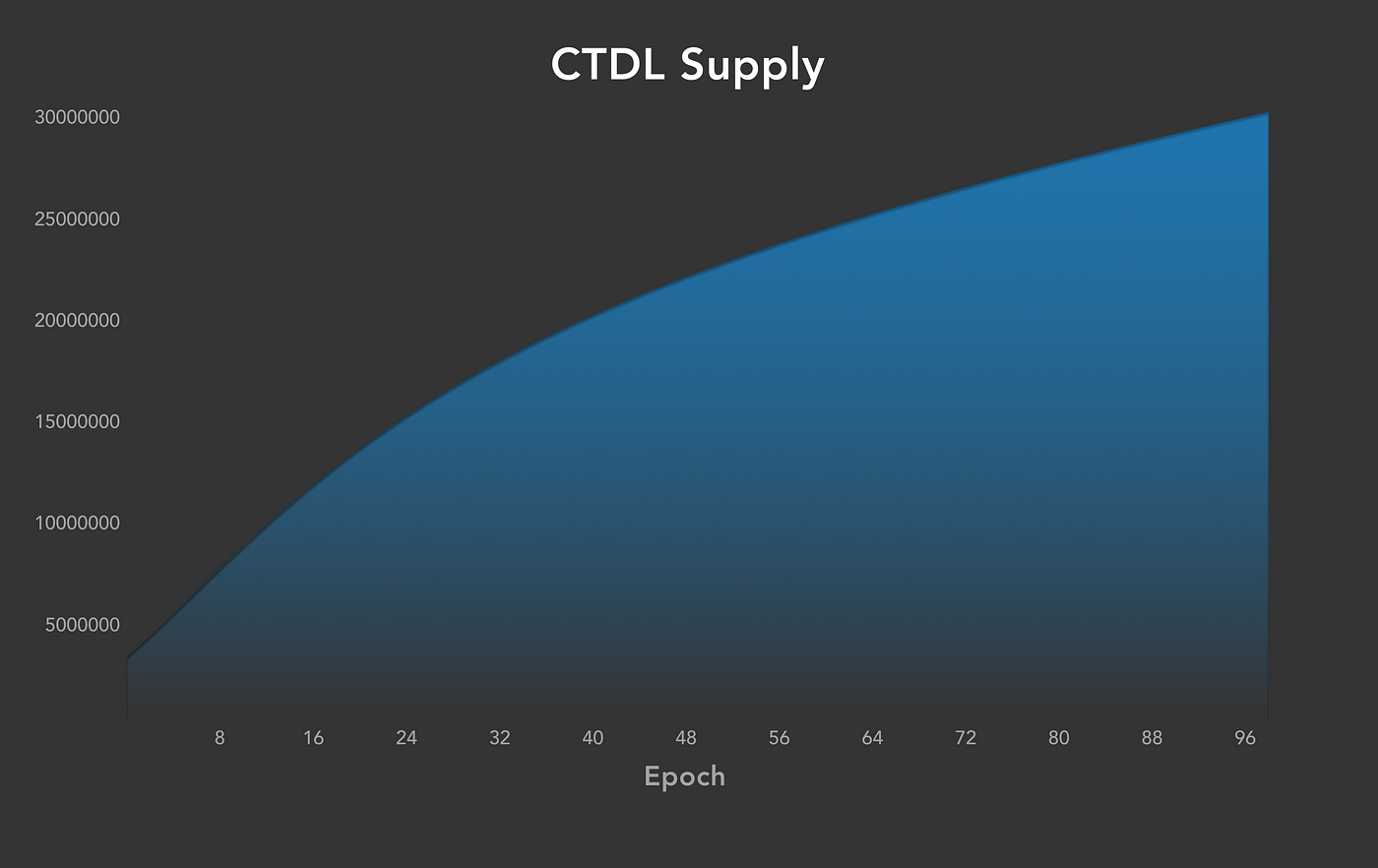

CTDL Emissions & Supply Curve

each epoch is 3 weeks

CTDL Emissions

CTDL Supply

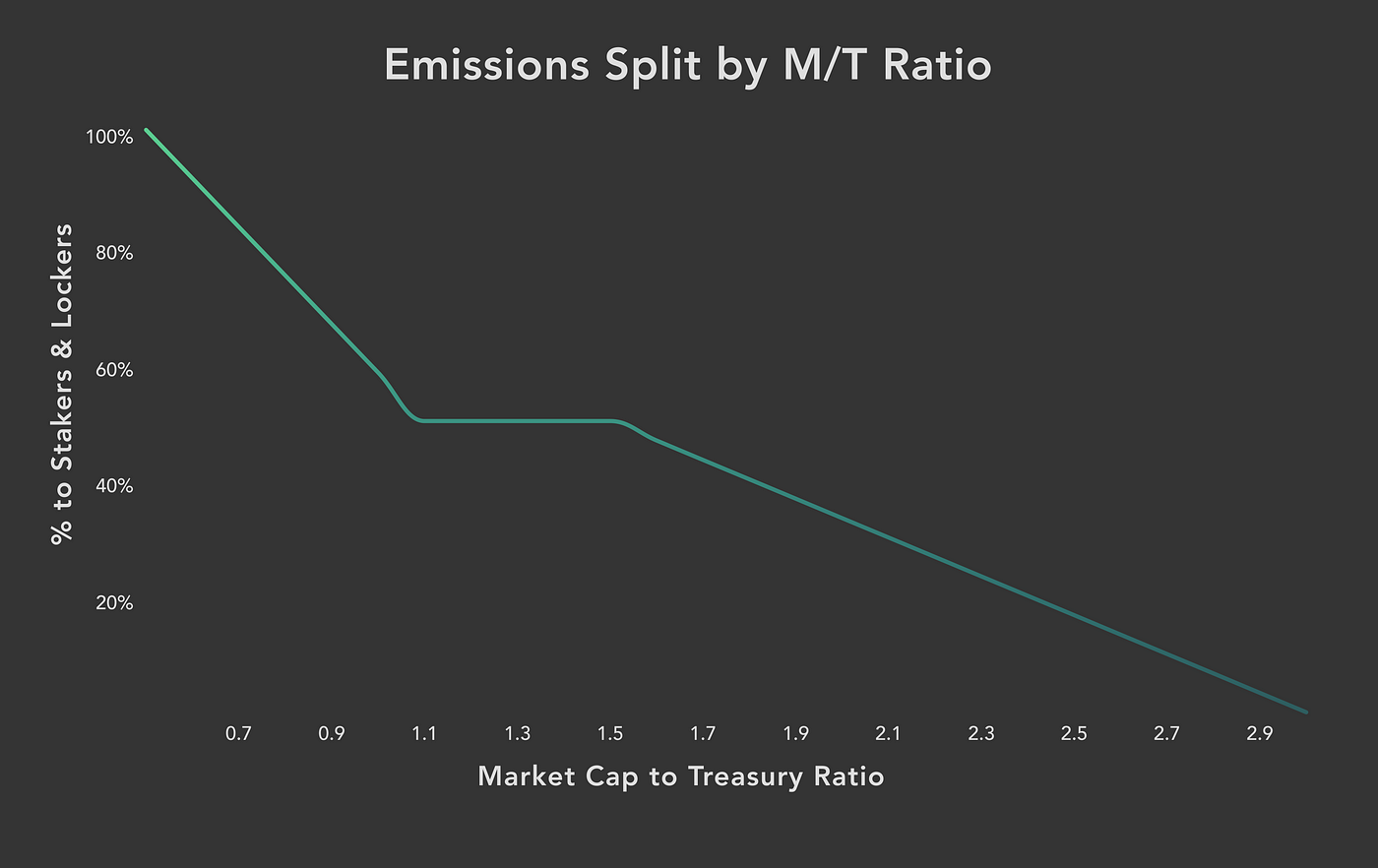

Elastic Emissions

CTDL emissions are distributed to

- locked CTDL, staked CTDL

- Treasury Funding

based on the percent of supply staked and the current Market Cap to Treasury ratio.

Emissions Split Example

Rewards for vlCTDL and xCTDL

vlCTDL holders: CTDL APR, strategy yielding BTC, and bribes

xCTDL holders: CTDL APR

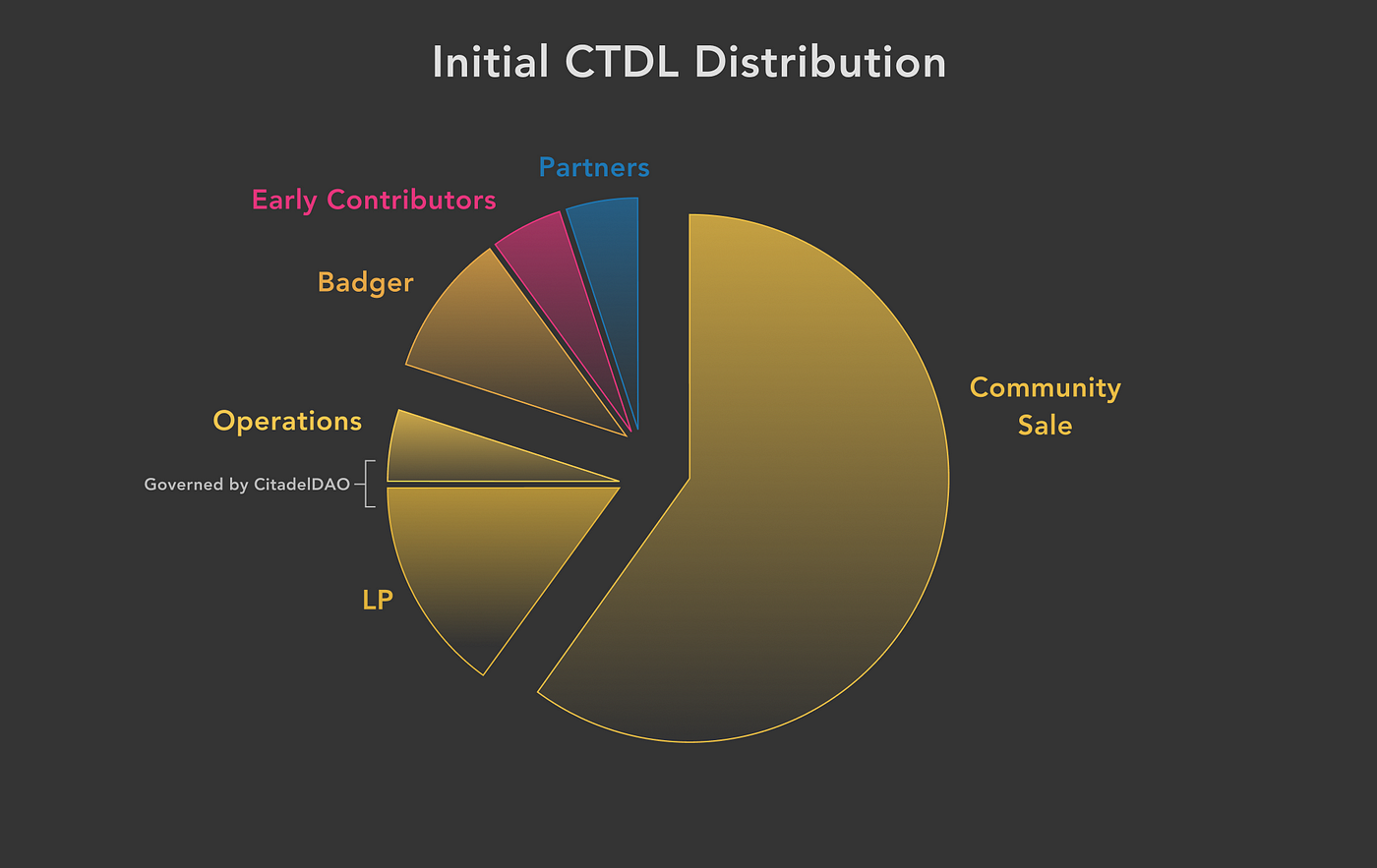

Initial Allocations

Treasury Strategies

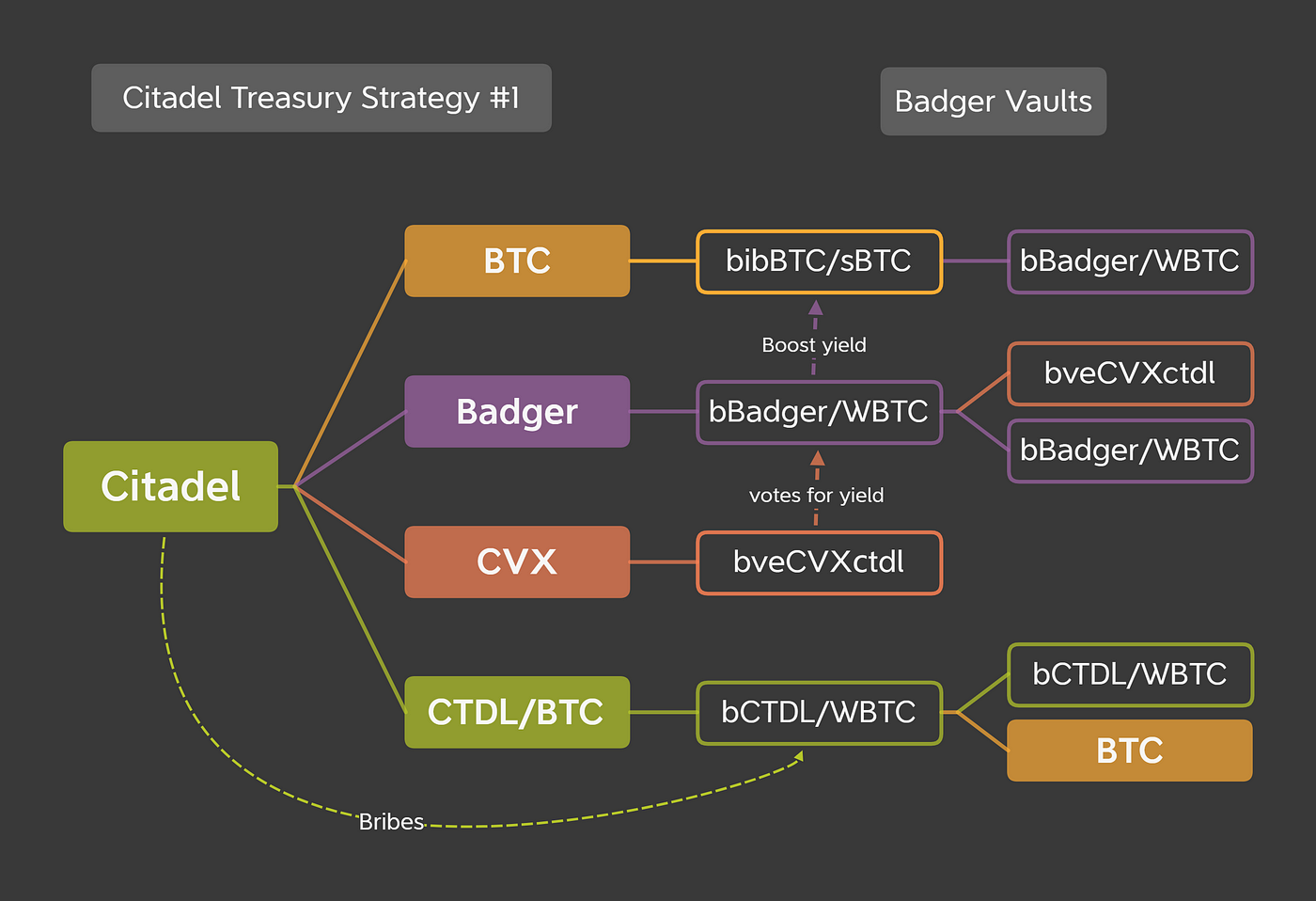

Citadel Strategy #1: Convex + Badger

https://thecitadeldao.medium.com/an-insight-into-citadeldao-treasury-strategies-aa2456e3bba1

Treasury Yield Policy

- Funding Revenue

- 10% to holders of vlCTDL

- 10% to the DAO

- 80% to the Treasury

- Treasury Yield

- 50% of yield to holders of vlCTDL

- 50% of the yield will be used for auto-compounding treasury positions

https://thecitadeldao.medium.com/an-insight-into-citadeldao-treasury-strategies-aa2456e3bba1

Citadel Initial Sale Parameters

https://thecitadeldao.medium.com/citadel-initial-sale-parameters-8bec5c957066

Partners

- Alchemix

- Convex Finance

- Frax

- Jones DAO

- Redacted

- Ren Protocol

- Tokemak

- Tribe DAO

Citadel x Badger

Citadel is a sub-dao of Badger.

BadgerDAO

https://rekt.news/badger-rekt/

Code

https://github.com/Citadel-DAO/citadel-contracts

BrickedStrategy.sol

CitadelMinter.sol

CitadelToken.sol

Funding.sol

GlobalAccessControl.sol

Importer.sol

KnightingRound.sol

KnightingRoundGuestlist.sol

StakedCitadel.sol

StakedCitadelVester.sol

SupplySchedule.sol

interfaces/

lib/

mocks/

oracles/

test/

Discussion

- Pros and cons

- APE IN or NOT

- Potential Risks

- Valuation of CTDL token

- TVL in initial sale (prediction)

Reference Links

- https://citadeldao.io/

- https://twitter.com/TheCitadel_DAO

- https://docs.citadeldao.io/

- https://thecitadeldao.medium.com/introducing-the-citadel-dao-551849104d26

- https://thecitadeldao.medium.com/tokenomics-deep-dive-a11e7f5e2083

- https://thecitadeldao.medium.com/an-insight-into-citadeldao-treasury-strategies-aa2456e3bba1

- https://thecitadeldao.medium.com/citadel-initial-sale-parameters-8bec5c957066

- https://forum.citadeldao.io/t/citadel-initial-sale-proposal-rff/

- https://twitter.com/HaowiWang/status/1516606391468773377